Introducing Apple Card; The Future Of The Credit Card?

By Sofy Robertson

Images provided by Apple

Apple has announced the introduction of Apple Card, an “innovative new kind of credit card” that is designed to help customers lead a healthier financial life. (Apple)

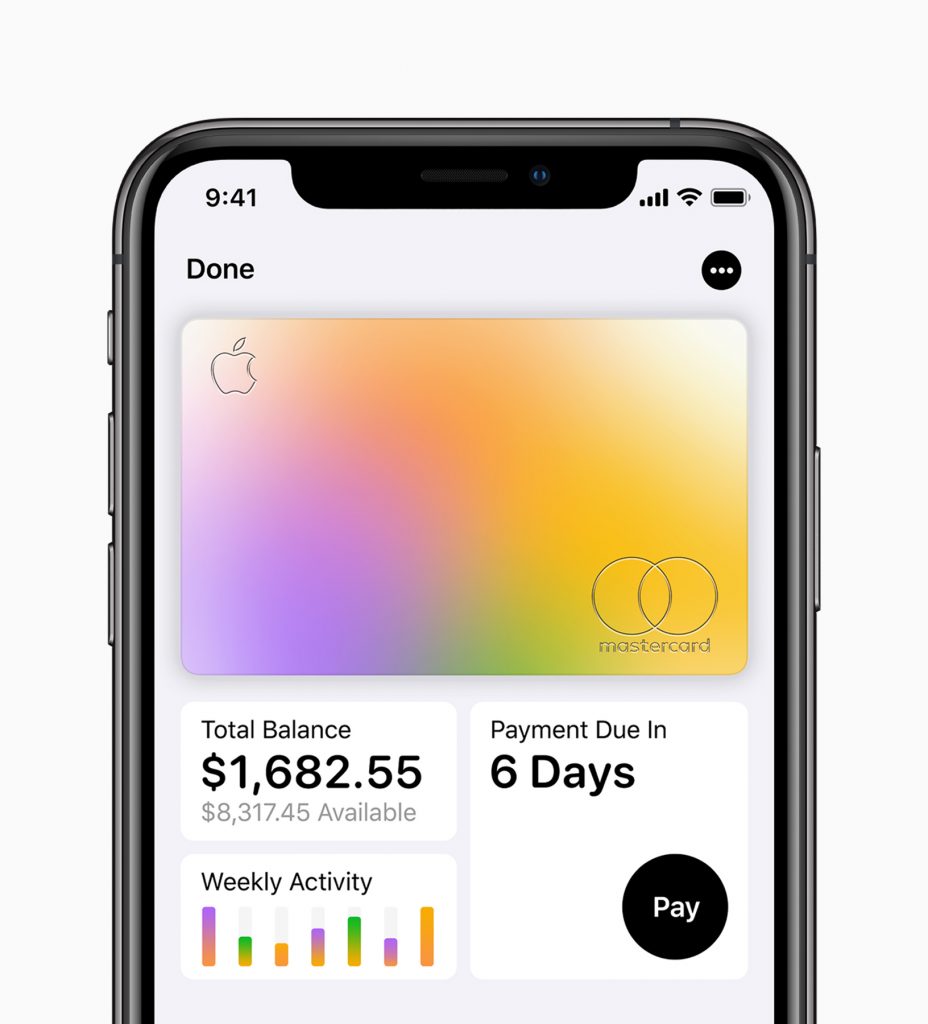

Apple Card is built into the existing Apple Wallet app on iPhone and offers customers a familiar experience with Apple Pay and the ability to manage their card on their phone.

Apple Card is designed to simplify the application process, eliminate fees, encourage customers to pay less interest and provide a new level of privacy and security.

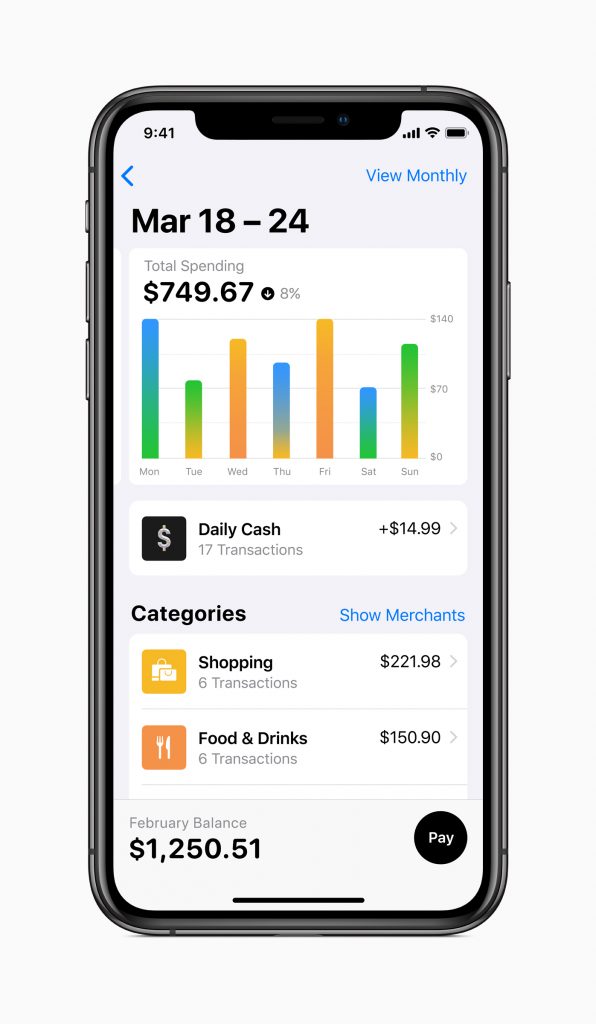

Apple Card will be available in the US this summer and will offer a clear and compelling rewards programme to give back a percentage of every purchase as cash on customers’ Apple Cash card each day. This money can be used straight away for purchases using Apple Pay or can be put towards their Card balance or sent to family and friends in Messages. Customers will receive 2 per cent daily cash when using Apple Card or Apple Pay and will receive 3 per cent for purchases made directly with Apple.

Jennifer Bailey, Apple’s Vice President of Apple Pay explained:

“Apple Card builds on the tremendous success of Apple Pay and delivers new experiences only possible with the power of iPhone. Apple Card is designed to help customers lead a healthier financial life, which starts with a better understanding of their spending so they can make smarter choices with their money, transparency to help them understand how much it will cost if they want to pay over time and ways to help them pay down their balance.”

Customers will be able to sign up for the Card in the Wallet app on their iPhone and start using it straight away in shops, on apps and worldwide. Apple Card gives customers “real-time views of their latest transactions and balance” within the Wallet app. Support for the card will be available 24/7 by sending a text from Messages.

Customers will be able to view purchases that are automatically totalled and organised by colour-coded categories such as Food and Drinks, Shopping and Entertainment. Weekly and monthly spending summaries will be available to view in Wallet.

Unlike ‘regular’ credit cards, there are no fees associated with Apple’s version; no annual, late, international or over-the-limit fees. The company’s goal is also to provide interest rates that are among the lowest in the industry and if a customer misses a payment, they will not be charged a penalty rate, although this will result in additional interest accumulating towards the customer’s balance.

Apple aim to promote informed decision making for their customers’ finances and their Card therefore shows a range of payment options and calculates the interest cost on different payment amounts in real time.

To create a new level of privacy and security, a unique card number is created on iPhone for Apple Card and is stored safely in the device’s Secure Element, a special security chip used by Apple Pay. Purchases remain secure through the use of Face ID or Touch ID and a one-time security code.

To provide additional support, Apple is partnering with Goldman Sachs and Mastercard. David M. Solomon, chairman and CEO of Goldman Sachs said:

“Simplicity, transparency and privacy are at the core of our consumer product development philosophy. We’re thrilled to partner with Apple on Apple Card, which helps customers take control of their financial lives.”

Ajay Banga, president and CEO of Mastercard, said:

“We are excited to be the global payments network for Apple Card, providing customers with fast and secure transactions around the world.”

For those locations that are not Apple Pay ready, the company has designed a titanium Apple Card with no card number, CVV security code, expiration date or signature on the card to increase its security.

At present, no plans have been announced to bring the Card to the UK or to any countries outside of the US. It is probable that if Apple’s partnership with Goldman Sachs and Mastercard is successful, then the companies will look at new opportunities elsewhere.

For more information, visit Apple’s website.